E-File your 2022 W-2/1099 Forms with the

State of Kansas

Filing Requirements

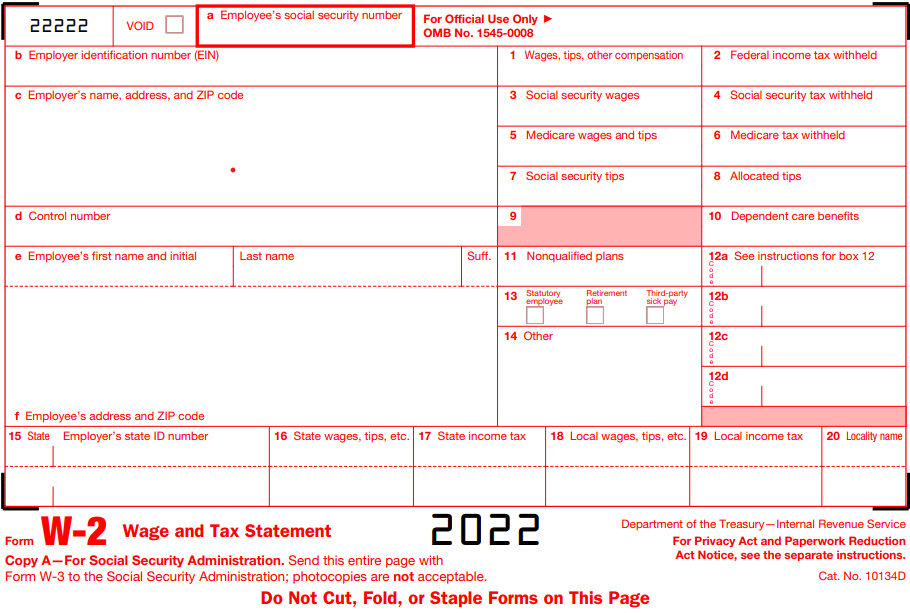

Form W-2

Employers in the State of Kansas must file Form W-2 with the state agency even if there is no state tax withholding. Form W-2 is an information return that reports consist of the wages, and taxes withheld such as social security, or Medicare.

The state of Kansas mandates the filing of Annual Reconciliation Form KW-3 along with W-2 Forms

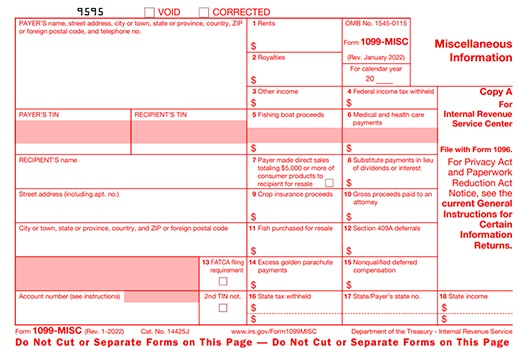

Learn MoreForm 1099

The State of Kansas participates in the CF/SF program, where the 1099 Forms filed with the IRS are automatically forwarded to the participating States. Although Kansas participates in the program, it mandates the filing of 1099 Forms directly with the State only if there is a State tax withholding.

Form 1099s report payments made to individuals other than employees like independent contractors, interest income, dividends & distribution, real estate proceeds, etc.

The State of Kansas mandates the filing of Annual Reconciliation of Income Tax Withheld Form KW-3 along with the 1099 Forms.

The following 1099 Forms are required to be filed with the state of Kansas.

Due Date to File 2022 W-2/1099 Tax Forms with the State of Kansas

Form W-2

31st

January 2023

Form 1099

31st

January 2023

Form KW-3

31st

January 2023

E-File Your W-2/1099 Tax Forms Now & Avoid Penalty.

Start E-filing NowInformation Required to E-File 2022 W-2 & 1099 Forms

The following details required to file W-2/1099 Forms are as follows:

- Employer/Payer Information: Name, EIN/SSN, Employer Type, and Address

- Employee/Recipient Information: Name, EIN/SSN, Address, and Contact Information

- Federal & State Filing Information: Federal, & Kansas State Income and Tax Withholdings.

Advantages of E-filing

E-filing involves simple steps so that filing of returns can be completed within the deadline and eliminates the difficulties involved in paper filing. The IRS will send the acknowledgement after receiving the forms & filing status Besides, E-filing offers you the convenience of accessing the filed returns and keeps them organized in one place.

Kansastaxfilings.info - A Comprehensive Tax Filing Solution for Payroll Tax Forms

Our Tax Filing application helps businesses and tax professionals to e-file W-2 and 1099 Forms securely. File W2/1099 tax returns from anywhere and at any time with our cloud-based solution.

What makes Kansastaxfilings.info the most trusted e-filing solution?

With our cloud-based application, e-filing of W2/1099 Forms can be completed with simple steps. Bulk upload feature allow users to import all the information for multiple recipients/corresponding payer at once. We handle the printing and mailing of hard copies to each of the employees/recipients. Users can also access the previously filed returns any time.

We at kansas tax filings, offer an easy-to-use web-based e-filing application where businesses of any size can directly file all the federal employment tax Forms such as W-2, 1099 (NEC, MISC, INT, DIV, R, S, & B), 941, 940, 1095 series Forms & W-2/1099 Correction Forms.

Click here to learn more about the Forms supported and related features.

Start E-filing NowHow to E-file W2/1099 Forms with the State of Kansas

Create the free account and select Form (W-2/1099) on our reliable online filing software. Then follow the step-by-step instructions below to

file W-2 online and 1099 Forms easily:

- Add Employer/Payer information

- Add Employee/Recipient information

- Enter Federal & State details includes wages, payment, taxes withholding, etc.

- Finally, Review, Pay and transmit the Forms

Kansas Paystub Generator

Whether you're in Wichita, Overland Park, Kansas City or anywhere in Kansas state, our Kansas paystub generator will calculate the taxes accurately. There is no need for desktop software. Save time and money with the paystub generator that creates pay stubs to include all company, employee, income and deduction information. Just follow the simple steps and email your paycheck stub immediately, ready for you to download and use right away.

Get Your First Paystub for Free

Generate Pay Stub NowNeed Help in e-filing your W2/1099 tax return?

We are always ready to assist you. Reach out to our U.S Based support team operating from Rock Hill, South Carolina. Reach out our support team over the phone (704.684.4751) or e-mail any queries to support@taxbandits.com.